Launched by the Impact Investment Exchange (IIX), the initiative is supported by a Steering Committee comprising entities that include the Australian Department of Foreign Affairs and Trade (DFAT) and ANZ Bank. The United Nation’s Capital Development Fund (UNCDF) is also part of its Advisory Council. Together, they intend to set benchmarks for gender bonds, funnel capital into appropriate debt securities, and provide practitioners with tools to foster a gender-inclusive financial landscape.

The OBI’s goal is clear: to unlock US$10 billion by 2030 to benefit 100 million women and girls worldwide. This urgency stems from studies indicating a potential 130-year wait to close the global gender gap, a timeline further challenged by issues such as the COVID-19 pandemic and climate change.

A tangible example of the OBI’s approach is the Women’s Livelihood Bond (WLB) series by IIX. This series consolidates various portfolios to issue stock exchange-listed Orange Bonds. Notably, the WLB5 is recognized as the world’s first Orange Bond and complies with ICMA’s Sustainability Bond Guidelines, bridging the gap between gender equity and climate action goals.

WLB5 also demonstrates an emphasis on the Women, Peace, and Security (WPS) agenda. By facilitating loans for housing and water sanitation in underserved areas, these bonds aim to provide safety and boost women’s participation in community decisions.

Orange Bonds’ inclusive approach is apparent in their diverse investment strategy. For instance, they address the fact that women in developing countries often face climate challenges head-on. Consequently, the OBI’s strategy spans from promoting financial equity, to advancing affordable housing initiatives.

The Refugee Impact Bond is a notable addition, directing resources to the Near East Foundation (NEF). This bond seeks to assist Syrian refugees in Jordan and Lebanon, addressing challenges of forced migration. Data does suggest a positive relationship between gender equality, governance, and peace, indicating that nations with a higher representation of women in various roles tend to experience less internal turmoil.

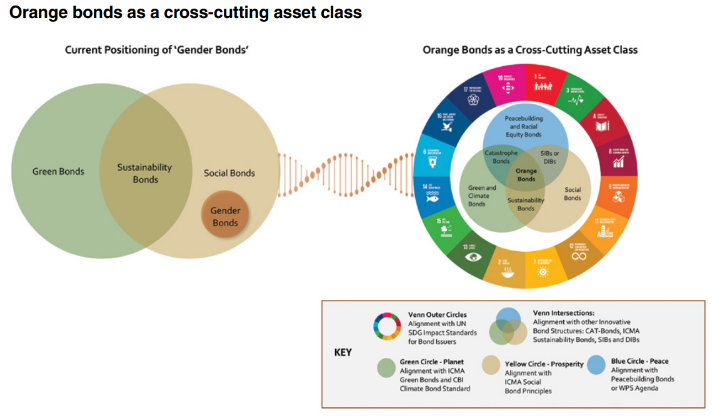

In essence, Orange Bonds have the potential to influence peace by supporting equitable job opportunities for women in vulnerable areas. Their adaptability ensures compatibility with other sustainable debt asset classes. Furthermore, their alignment with broader sustainability goals indicates their broad utility.

Johan Galtung’s work from the 1960s reminds us that peace isn’t simply the absence of violence. Through endeavors like the OBI, there’s an effort to foster conditions that actively promote equality, prosperity, and sustainability. The Orange Bond Initiative represents a step in the direction of blending finance with tangible positive outcomes, highlighting the interconnectedness of gender equality, sustainable development, and peace.

Discover more on the Orange Bond Initiative by downloading the full briefing below or by clicking here.