Global interest in ethical investment is growing. More companies and funds are committing to finding solutions for the world’s challenges through sustainable investment.

Analysis from the Institute for Economics and Peace (IEP) shows that Positive Peace measurements for countries can guide ethical investors looking for investment options. Considering the level of environmental, social and governance (ESG) performance of any country is just as relevant as any company or corporation, especially for investors interested in the creditworthiness of a nation or the economic trajectory of frontier and emerging markets.

Findings from IEP’s analysis shows that the indicators used to measure the Positive Peace Index maintain a high correlation with commonly accepted ESG indicators used by investment funds. The correlation coefficient between the Positive Peace Index (PPI) and sovereign ESG scores computed by BNY Mellon’s Insight Investment for 186 countries in 2018 is 0.91.

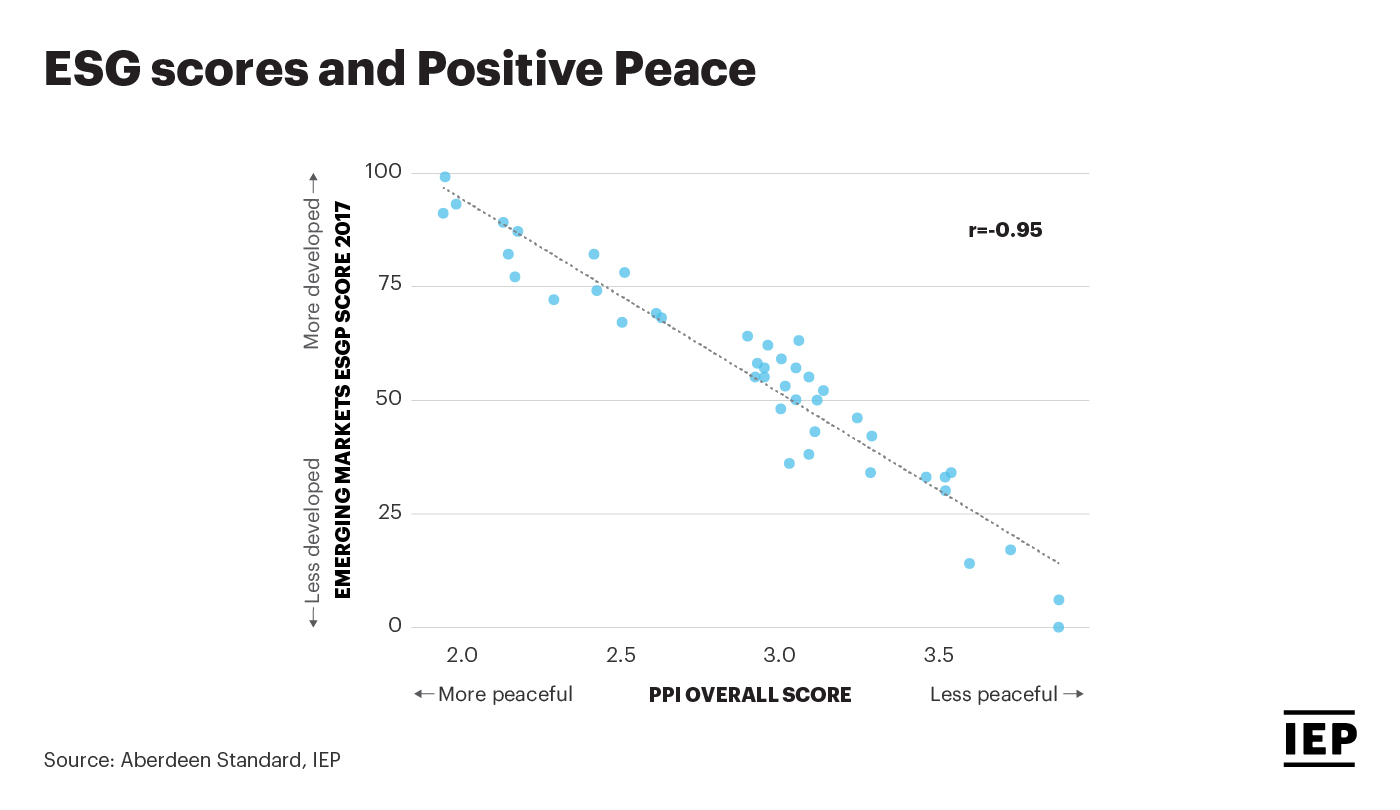

For emerging markets, ESG sovereign scores computed by Aberdeen Standard Investments match the PPI with a correlation coefficient close to one in absolute value. Lazard Asset Management’s emerging markets debt team have computed sovereign ESG scores whose absolute value correlation coefficient against the PPI Score is 0.87.

Positive Peace can be used in financial markets to help ethical investors identify reliable and sustainable growth opportunities. A reliable gauge of economic resilience, Positive Peace can also be used to select portfolios of countries that consistently outperform global gross domestic product (GDP) growth. Improvements in Positive Peace are statistically associated with better performance in a range of macro-economic indicators, including stronger GDP growth, stronger flows of foreign direct investment, appreciating currencies, lower and more stable interest rates, and inflation rates.

Per capita GDP is highly correlated with the Positive Peace Index Score. Data for 2019 shows that for every one index point improvement in Positive Peace, GDP per capita increases tenfold. Domestic currency in countries where Positive Peace improved appreciated by over one percentage point per year more than countries where it deteriorated. Among countries where Positive Peace improved, household consumption rose in the past decade at a rate almost twice as high as for countries where the PPI deteriorated, and growth in business activity improved up to 2.6 times higher.

Nations that improve in Positive Peace consistently outperform comparable countries in real GDP growth. By choosing countries that advance in Positive Peace in a given year and mapping their real GDP growth in the subsequent year, investment analysts can build an annually rebalanced portfolio of countries that outgrows the global average by one percentage point per year.

Other macroeconomic gauges such as consumption, business valued added and capital expenditure, also perform better in countries with improving Positive Peace. Using financial market instruments that mirror domestic economic performance, one could generate above global average returns for ethical investors interested in promoting Positive Peace.

The Positive Peace Index uses 24 indicators to analyse 163 countries that are improving or deteriorating in Positive Peace. Since 2009, 134 of the 163 countries measured on the index have improved.